Cambridge Tops UK Retail Rankings as Chelsea Soars and Malls Reign Supreme

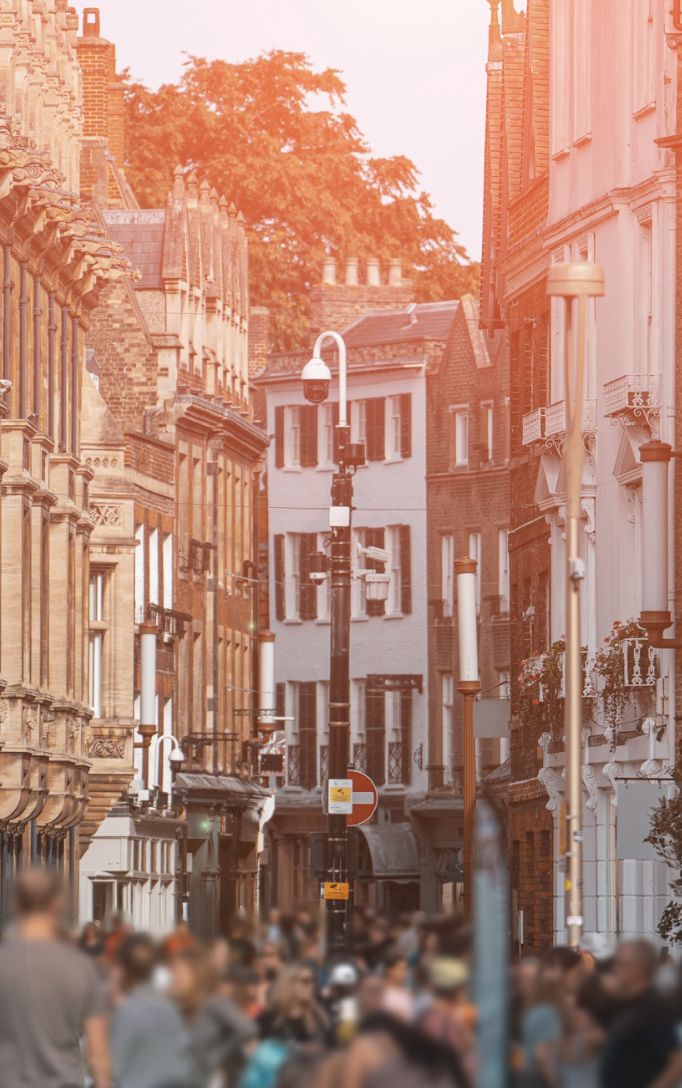

Newmark has unveiled its latest UK Retail Vitality Rankings report, marking the tenth year of its comprehensive analysis of the nation's retail landscape. This annual report meticulously assesses the health of 1,000 retail centres across the country, integrating crucial metrics such as shopper spend, vacancy rates, retail mix, redevelopment activity, and catchment suitability to pinpoint the most dynamic and thriving locations. For yet another year, Cambridge firmly holds the coveted top spot, attributed to robust demand fueled by its affluent resident base, a significant student population, and a resilient evening economy that collectively contribute to its enduring vitality.

A notable surge in this year's rankings sees London’s Chelsea ascending dramatically from 10th place last year to an impressive second position. This remarkable rise is powered by substantial affluent local spending, a strong influx of tourism, and a premium retail mix that continues to attract high-end brands. Chelsea has long been recognized as a retail hotspot, with the past year witnessing a significant number of new store openings by both major retailers and independent boutiques along the iconic King’s Road. Similarly, Sloane Street has continued to attract expansion and new presences from leading global luxury brands, solidifying its status.

Among other significant highlights in the report, Bluewater in Kent has secured the fifth spot. Once renowned as the UK's (and Europe's) largest mall following its 1999 opening, it has since been surpassed in size by numerous other large-scale developments. However, Newmark identifies it as the UK's leading mall, revitalized by the integration of experiential and digitally native brands alongside prominent "destination" stores. Inditex, for instance, has opened or is in the process of opening a raft of its diverse brands there, while Bluewater has also emerged as a significant beauty hub, hosting major names like Sephora, Space NK, Rituals, Molton Brown, Boots, and Superdrug. Furthermore, Next has taken over the expansive department store space previously occupied by House of Fraser, with plans to open a massive new branch next year, showcasing its own brand alongside acquired and third-party labels.

Manchester has achieved an astonishing ascent of 96 places, now sitting at number 12, a testament to its "regeneration-led success story." This growth is robustly fueled by its burgeoning cultural anchors and the arrival of premium brands, solidifying its reputation as the UK’s 'second fashion city' in recent years. The city recently saw the opening of JD Sports’ largest UK store, a location that is reportedly performing exceptionally well. However, Manchester was not the highest climber on the list; that distinction goes to Glasgow’s Silverburn, which soared an incredible 530 places to secure the 215th position, currently undergoing a significant transformation into a premium retail and leisure destination with several major new occupiers.

The report also details the performance of various other key locations across the UK. Kingston upon Thames moved up two spots to claim third place, while Bath City Centre experienced a significant leap of 18 places to number four. Wimbledon Village, despite a slight drop of three positions, maintained a strong presence at sixth place. Milton Keynes climbed 11 spots to seven, and Knightsbridge saw a marginal fall of two places to eight. Leeds City Centre demonstrated strong growth, jumping 25 spots to ninth. Westfield Stratford City slipped three places to number 10, and Liverpool City Centre made a substantial leap of 26 places to reach number 11.

Newmark's analysis also highlights a notable shift in the regional retail landscape. While London and the South East continue to exert dominance, an increasing number of cities from the Midlands and Northern regions are successfully entering the Top 50. Conversely, the report cautions that many smaller towns are facing mounting pressures, struggling with high operating costs and weaker catchment areas, underscoring a growing disparity in retail vitality. The rankings further identify four fundamental structural shifts that are currently reshaping the UK retail sector: the pronounced ‘flight to prime’ locations, the emergence and proliferation of ‘phygital’ store formats that seamlessly integrate physical and digital experiences, the growing critical role of experience anchors in attracting and retaining customers, and the persistent policy challenge posed by outdated business rates.

A particularly compelling insight from the report is the observation that many of the top-performing locations either contain or are themselves 'supermalls'. Newmark’s 2025 Vitality Rankings unequivocally demonstrate the paramount importance of large retail centres to the overall UK retail landscape. While a significant portion of consumers maintain loyalty to their local high streets and independent retailers, the magnetic draw of major cities and destination malls has distinctly returned to the forefront. These large-scale locations, characterized by their critical mass of space and extensive array of retail, food & beverage (F&B), and leisure options, are once again successfully attracting high levels of footfall. Beyond mere footfall, there is an intensified focus on customer retention, with new concepts such as experiential retail and location-based entertainment designed to "drive dwell time and repeat visitation, which results in higher spend per visit at a retail centre." Customers are increasingly drawn to innovative concepts, with the wellness sector, in particular, experiencing considerable recent growth. These pioneering concepts often combine immersive customer experiences with essential services and product sales, progressively occupying prime retail spaces on high streets and within shopping centres, thereby significantly enhancing the overall vitality of these retail environments.